MORE INFORMATION

Medicare Decisions

What is Medicare?

Your medicare choice:

- Original Medicare (consisting of Part A and Part B) or a

- Medicare Advantage Plan (Part C). Additional coverage options, such as Medicare drug coverage or Medigap, may also be necessary for some individuals.

Medicare has its own page to assist you in comparing your coverage options and determining the best fit for you. You can find it here.

Original Medicare:

Original Medicare, as previously stated, includes:

- Medicare Part A (Hospital Insurance) and

- Part B (Medical Insurance).

Medicare Part D (drug coverage) is also available as a separate plan.

With Original Medicare, you have the freedom to visit any healthcare provider that accepts Medicare anywhere in the United States. To cover out-of-pocket costs, such as coinsurance, additional supplemental coverage can be purchased.

To learn more about Original Medicare, please visit the official website for more information.

Medicare Advantage (also known as Part C):

Medicare Advantage, also known as Part C, is a type of Medicare-approved plan offered by private companies as an alternative to Original Medicare. These “bundled” plans typically include coverage for Part A, Part B, and often Part D as well.

With Medicare Advantage, you may be required to use healthcare providers within the plan’s network. Additionally, out-of-pocket costs may be lower than those associated with Original Medicare, and some extra benefits may be included.

When to File

Initial Enrollment Period

Special Enrollment Period

General Enrollment Period

Medicare Costs

Income Related Monthly Adjustment Amount (IRMAA):

IRMAA is a surcharge added to your base premium for, essentially, earning too much money. In 2023, if you earn over $97,000 as a single filer or over $194,000 as a joint filer, then IRMAA applies to you. It’s important to keep up-to-date with the income requirements as they change on a yearly basis.

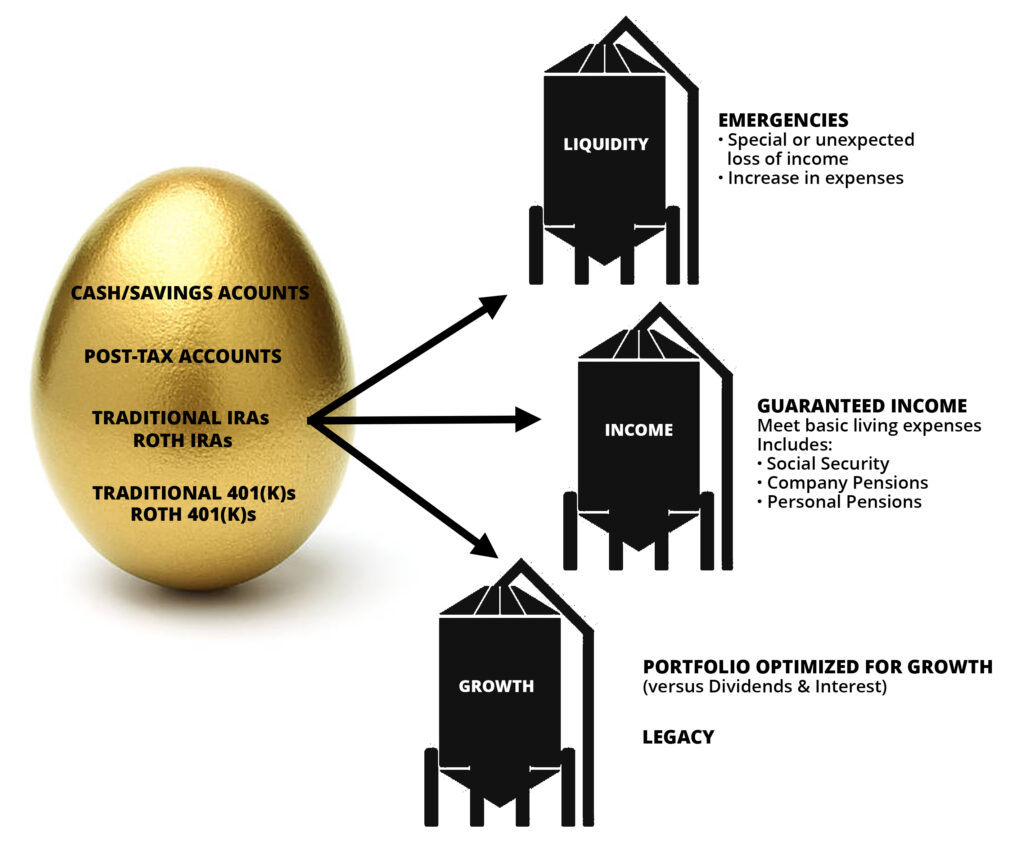

The adjustment is based on the income claimed in your most recently filed tax return, which is the income you earned two years prior. For example, your 2023 IRMAA adjustment is based on your 2021 income. This has implications for any planned Roth conversions, 401(K) withdrawals, and sales of stocks and bonds, so it is important to time things right.

Fortunately, there are ways to appeal IRMAA if you have experienced a qualifying life-changing event, such as the death of a spouse, divorce, or marriage.