We Get It. You're Busy!

Just figuring out your present financial situation can be time consuming, strenuous and frustrating. Now imagine trying to determine your financial situation in 30 years! It’s our job to ensure your retirement is financially sound and adjustable to everchanging needs and goals.

Our Process

Introduction Meeting

We have an introductory meeting to get to know each other, find out if we are a good fit for one another, discuss your overall finances and investment horizon, and build up the essential mutual trust necessary for such an important endeavour – your retirement!

Goals & Financial Diagnosis

Analysis & Strategy Development

Upon careful analysis, a retirement income plan is designed to not only reach your goals, but adjustable as necessary to changing realities, such as a loss of employment, disability, or relocation. If any aspects of the plan aren’t to your liking, alternative paths will be examined and delivered upon request – you’re never under any obligation to accept any decision you’re not comfortable with!

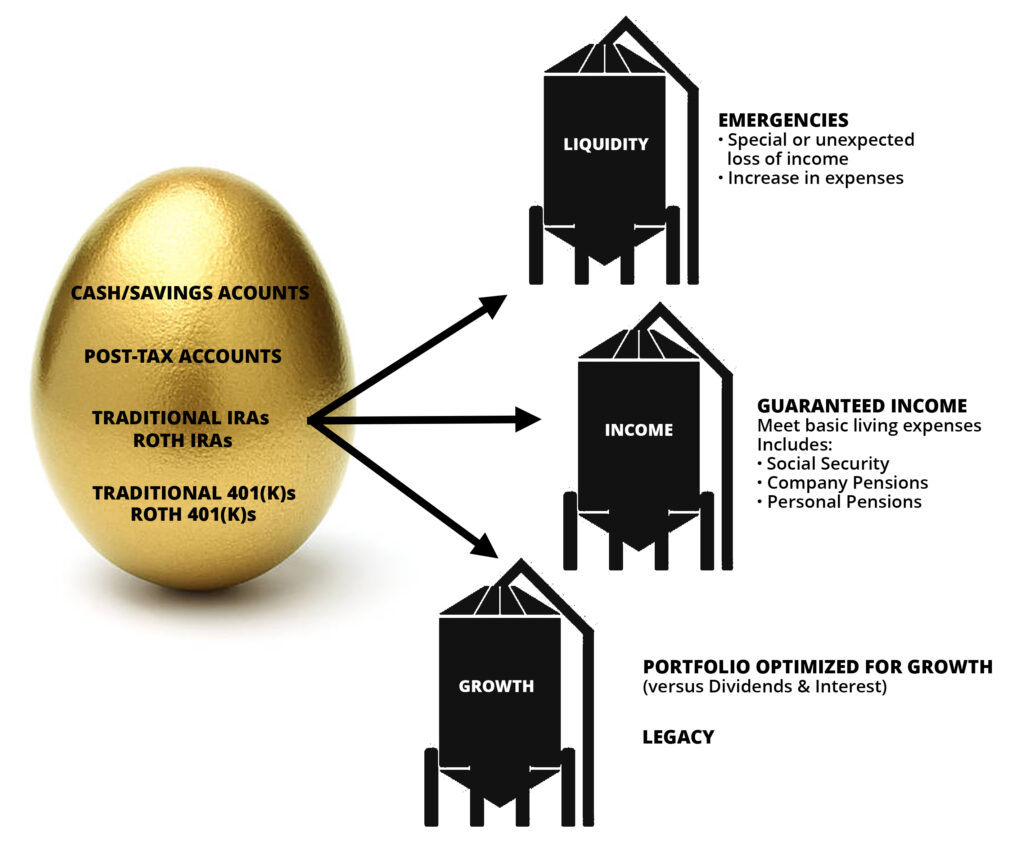

Income Insulation

One factor that didn’t play a very big role in previous generations’ retirement was inflation. Nowadays, people are spending 25+ years in retirement fairly often. In the same time frame, inflation can halve your retirement income’s purchasing power. Our decumulation strategies look 30 years into the future and adjust for inflation as much as it is possible.